Homeowners Insurance in and around Blue Bell

Blue Bell, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- Blue Bell

- Conshohocken

- Lafayette Hill

- Norristown

- East Norriton

- West Norriton

- Ambler

- Worcester Township

- Montgomery County

- North Wales

- Lansdale

- Collegeville

- Delaware County

There’s No Place Like Home

New home. New memories. State Farm homeowners insurance. They go hand in hand. And not only can State Farm help insure your home in case of tornado or fire, but it can also be beneficial in certain legal cases. If someone were to hold you financially accountable if they had an accident at your residence, the right homeowners insurance may be able to cover the cost.

Blue Bell, make sure your house has a strong foundation with coverage from State Farm.

Help protect your home with the right insurance for you.

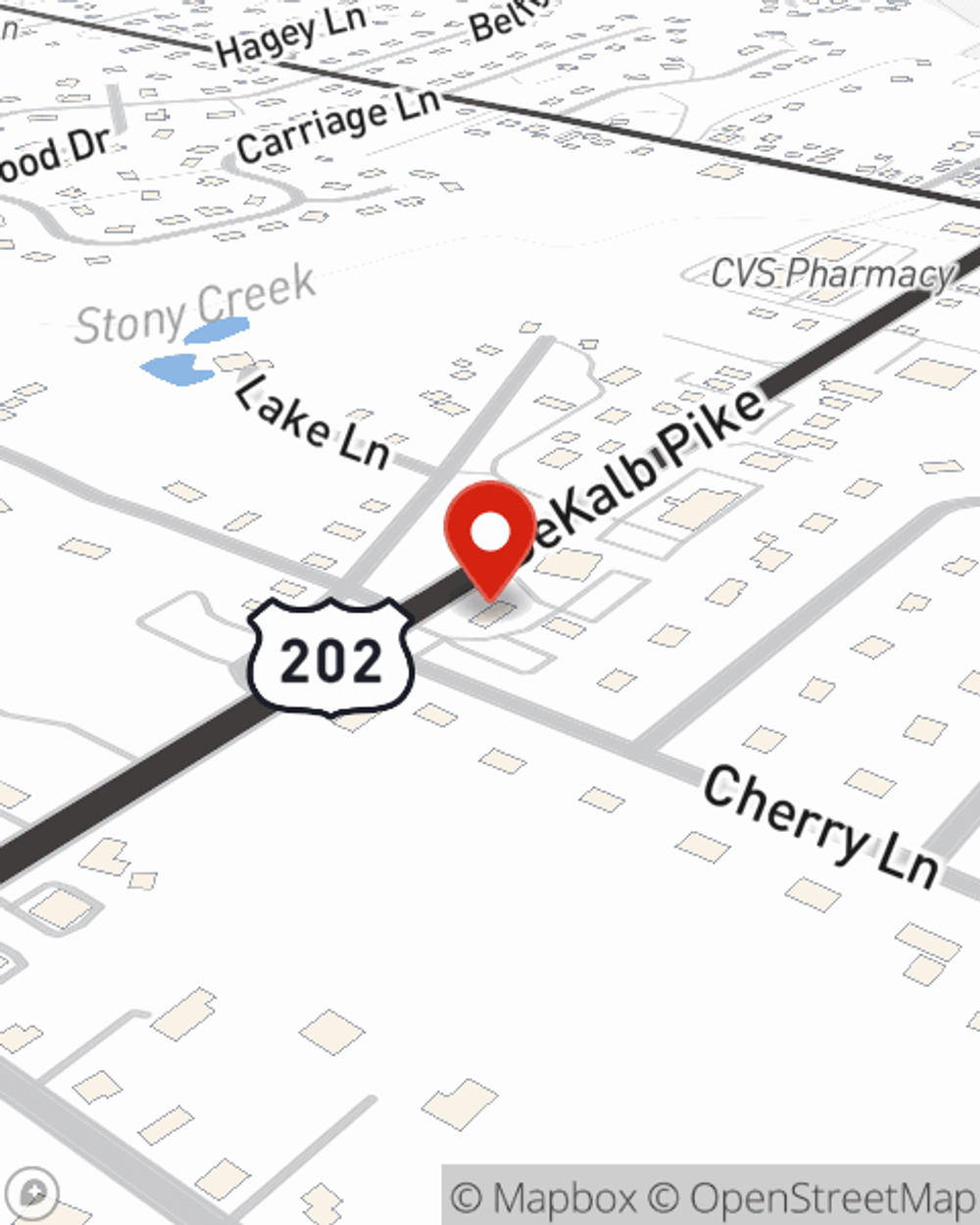

Agent Michael Groves, At Your Service

State Farm's homeowners insurance is the right move. Just ask your neighbors. And call or email agent Michael Groves for additional assistance with getting the policy information you need.

As a leading provider of home insurance in Blue Bell, PA, State Farm aims to keep your home protected. Call State Farm agent Michael Groves today for help with all your homeowners insurance needs.

Have More Questions About Homeowners Insurance?

Call Michael at (484) 674-7034 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

What to do during a tornado

What to do during a tornado

You see the alert. Your area is under a tornado watch, or even worse, a tornado warning. Know the differences between them, and what to do during a tornado.

Michael Groves

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

What to do during a tornado

What to do during a tornado

You see the alert. Your area is under a tornado watch, or even worse, a tornado warning. Know the differences between them, and what to do during a tornado.